In any diabolical twist of fates, there is always the most underdog dog, and in this inflation-stagflation-deflation-reflation global-local supply chain catastrophe there is always a greater loser from the losers.

In terms of commodities, there are a few oddball losers that we all have likely overlooked because many of our favorite celebrity analysts haven’t found a place for them in their model of future costs or supply and demand. For Example:

Shutdowns in auto production lines because there are no supplies of wire harnesses from Ukraine, and/or Chips from the China CoVid Lockdown. Even if the CoVid Lockdown ends tomorrow, how long will it take for supply to return to normal? Or if the war in Ukraine were to end today would there even be a process to start producing wire harnesses the next day? The next week, etc?

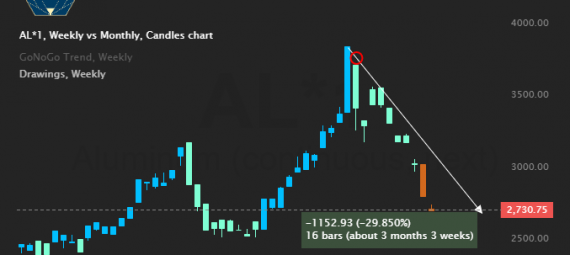

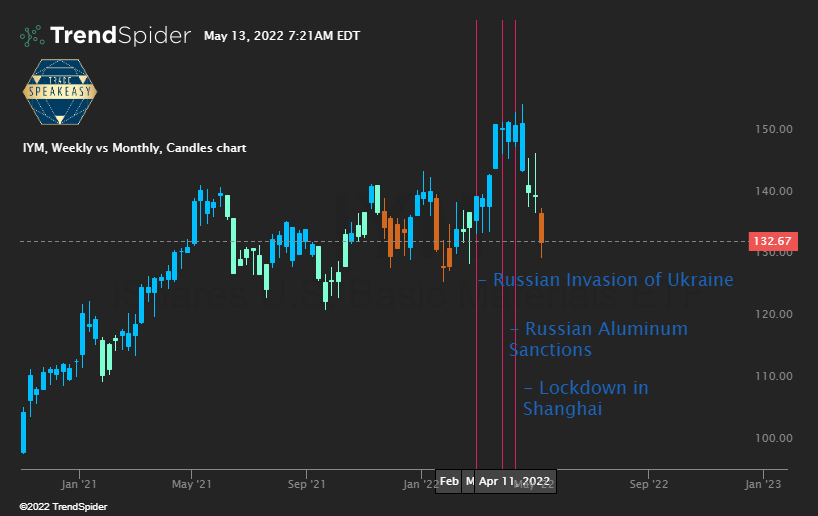

So in an environment where commodities have been skyrocketing, what we’re actually now seeing is margins of weakness from this phantom point of strength. Another example, with the ongoing conflict in Ukraine, and the effects this has on gas/electricity prices, zinc and aluminum smelters have had to close shop against the roaring cost of gas, which has and will have a massive impact on the automotive industry and the beverage industry that needs aluminum for cans.

Who would have thought that two months ago China shutting down aluminum factories to cut carbon emissions would need to be suddenly reversed following Russian sanctions, only that China can not export aluminum from those closed factors because of Covid lockdowns, which do not seem to be slowing in China! I mean, what a MESS!!!

There are areas where it’s clear no matter what happens with Russia – Belarus, Ukraine, or China, we will see higher prices and that’s in agriculture. One big constraint is the supply of Potash, which is imperative for fertilizer, already 18% of the world supply had been sanctioned in Belarus, and now adding the new Russian sanctions 40% of the world’s Potash supply is now sanctioned. Now combine that with the general nutrient shortage of nitrogen, phosphate, and potash because of the impact of natural gas and fertilizer plants, ammonia, and energy for phosphate shut off for potash; we know this will significantly affect crop yields.

This is only one example, but cotton and rice are starting to squeeze as countries start to protect supply for their citizens, leaving many import-heavy countries at a loss for options.

Every day this situation is changing, so join us at tradespeakeasy.com to get these types of updates more regularly.