It is often said ‘you should invest in healthcare’ since everyone will need healthcare at one point or another. But what does that mean? As healthcare may be divided into several categories such as:

- Drug Manufacture (PFE, MRNA, J&J, AMGN)

- Medical Service Providers (DGX,LH)

- Medical Devices and Tools (DXCM, TMO, DNR)

- Health Insurance Providers (UNH, CNC, CI, HUM)

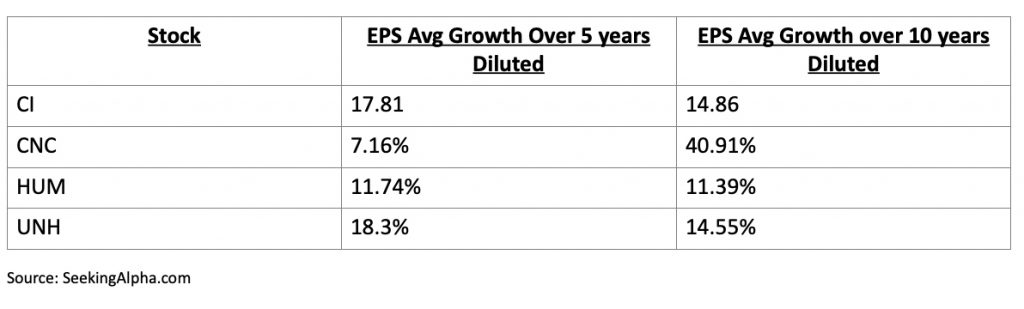

It is the Health Insurance Providers category that continues to see growth year over year.

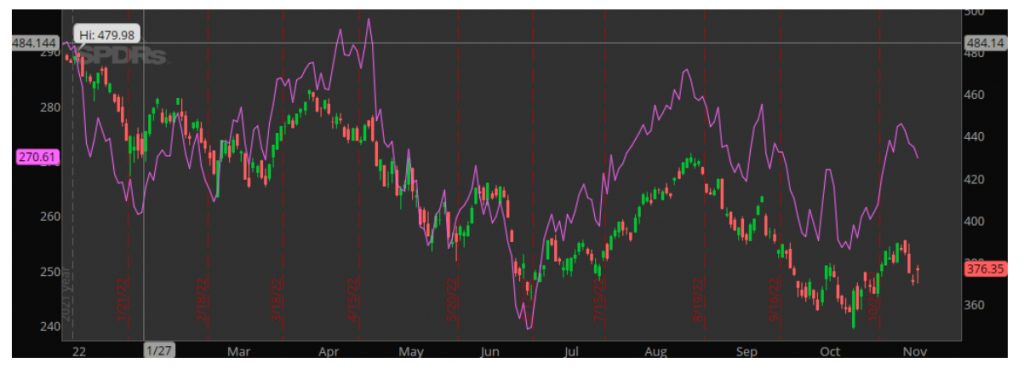

If we compare the 2022 year to date charts of SPY vs IHF, both SPY and IFH hit their lows for 2022 on 6/17. IHF reached higher highs in April 2022 and the ETF price has recovered more from its lows in comparison to SPY. As of 11/4/2022 SPY is down -21.5% from its January 1 open price while IHF is down -6.9% from its January 1 open price.

Healthcare Outlook

In 2019 US healthcare expenditures increased 4.3%. In 2020 mainly due to COVID-19 US healthcare expenditures increased 9.7% to 4.1 trillion dollars1. In 2021 health expenditures increased by 4.2%. The CMS 2021-2030 National healthcare projection report forecast healthcare expenditures increases of 5.1% per year2. The beneficiaries of these expenditure increases will be the healthcare sector in particular the health insurance providers making them a great addition to any individuals investing portfolio.

1CMS.gov

2Healthaffairs.org