In this blog, we are going to compare some of the most popular Trading Platforms. What are the pros and cons? What are the different features? Why might one be better than the other?

When picking the best Trading Platform, there are many factors to take into consideration.

Factors such as experience level, tools needed, and costs.

This review will give an in-depth analysis of three Trading Platforms so you can decide which is best for you.

What are Trading Platforms?

Put simply, trading platforms allow consumers to place orders for financial products such as stocks, bonds, currencies, commodities, and more. The Trading Platforms we are exploring are well-known for stocks and ETFs.

We will be reviewing the following Trading Platforms:

- Robinhood

- Webull

- TDAmeritrade

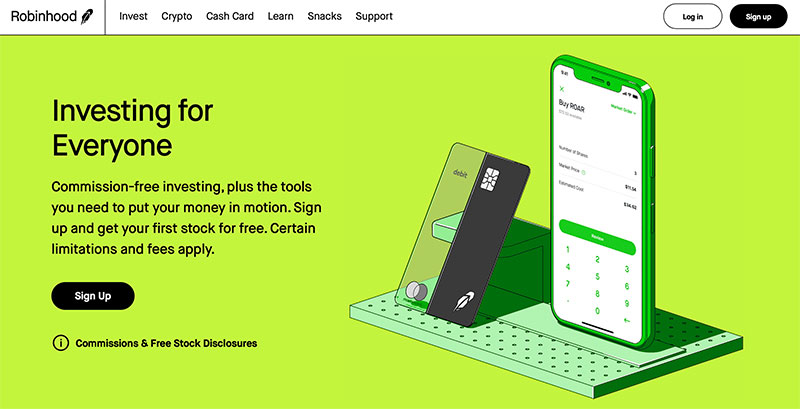

1. Robinhood

What we love

Robinhood’s motto is investing for all. Of all the trading platforms, Robinhood boasts its easy usability factor. It appeals to many new investors. Its streamlined interface makes trading easy for both its web platform and cell phone app. Investors can easily make a trade while on the go from their iPhone.

Furthermore, it meets every budget. Robinhood has great discounts with some of the lowest costs in the industry, offering options trades with no contract fee. Additionally, Robinhood was one of the earliest members to have fractional shares and access to cryptocurrency (which also offers fractional shares).

Pros:

- Beginner Friendly

- Easy to Use Platform

- Great Cell Phone App

- $0 Account Minimum

- $0 Stock Trading Costs

- $0 Option Trades

- Crypto Offerings

Room for Improvement

Some could argue Robinhood’s platform is too simple. It is lacking the in-depth tools that many of its competitors have. Robinhood has some of the basic technical indicators such as volume, Simple Moving Average (SMA), Exponential Moving Average (EMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), but not much more. Additionally, this trading platform doesn’t offer the ability to edit your charts. Such as adding trend lines, highlighting areas, shapes, and text.

Furthermore, Robinhood hasn’t always been reliable compared to other trading platforms. It has made great improvements, but things such as downtime and limited customer service haunts its reputation. The fact that Robinhood is free means that they can not provide the fastest order pick up, nor the best fill prices, however Robinhood’s presence in the market has forced more long-term platforms to become more competitive in their pricing.

Cons:

- Speed of Order Fill

- Does not provide the best Order Fill Prices

- Limited Technical Indicators

- Inability to Customize Charts

- Limited Customer Support

- Reliability

Overall, Robinhood is a great platform for beginners. It is also good for long term traders who do not need all the fuss of additional technical indicators and charting.

Link: https://robinhood.com/

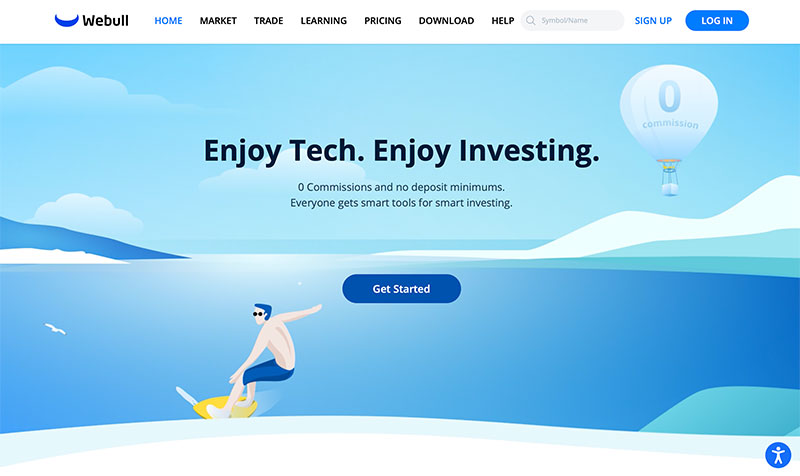

2. WeBull

What We Love

Some say there are many similarities between the trading platforms Robinhood and Webull. Similarly, to Robinhood, it is very user-friendly with minimal fees. Webull has $0 account minimum, trading fees, and options contract fees. It offers both fractional shares and cryptocurrency. Additionally, Webull has a streamlined web interface and cell phone app.

However, Webull allows more in-depth analysis. Compared to Robinhood, Webull has a broader selection of indicators and the ability to edit charts. This makes it appealing for Intermediate traders and investors.

Pros:

- Beginner and Intermediate Friendly

- Ability to Chart

- $0 Account Minimum

- $0 Stock Trading Costs

- $0 Option Trades

- Crypto Offerings

Room for Improvement

Compared to other trading platforms, Webull’s customer service is quite limited. It doesn’t offer a live chat. It has phone support, although from the reviews that can be found online, it doesn’t appear to work properly and customers have a hard time reaching support.

Although it does have more in-depth analysis than Robinhood, Webull still falls short in comparison to other trading platforms such as TDAmeritrade. For example, Webull offers about 10 technical indicators, whereas TDAmeritrade has over 400.

Cons

- Limited Customer Support

- Limited Technical Indicators

Webull is a great middle-ground for investors. If you want tools to help with trading such as technical indicators, but don’t want to lose a clean and simple interface, Webull is an excellent option.

Link: https://www.webull.com/

3. TDAmeritrade

TDAmeritrade is a robust trading platform. From over 400 technical indicators to in-depth charting tools, TDAmeritrade really stands out. Traders can backtest using TDAmeritrade’s On-Demand feature. For example, if you want to test out a put on a day the market was down, you can select that day and place the trade. Fast forward through the day and using historical data, you see if your put was profitable or not.

TDAmeritrade also has excellent customer support. It has live chat as well as a phone number to reach a live person. Their staff is very knowledgeable, with the ability to walk you through how to use the platform, how to exit a multileg trade, and pretty much any question related to their platform.

TDAmeritrade offers an array of account types, IRA, ROTH IRA, children’s trust accounts, margin and cash accounts which can all be synced, which makes managing multiple accounts extremely straightforward. TDAmeritrade does charge a small commission for opening and closing trades, but this commission provides for fast Order Fills for much more competitive prices, allowing its customers to make more money on every single trade.

Things We Love

Pros:

- Competitive Order Fill Times and Prices

- Advanced Friendly

- Over 400 Technical Indicators

- Trading Tools such as On Demand

- Excellent Customer Support

- $0 Account Minimum

- $0 Stock Trading Costs

- Crypto Offerings

Room for Improvement

As far as trading platforms go, TDAmeritrade’s can be quite confusing. They offer a 30-minute call to help navigate the platform, which could be argued as a necessity since the platform isn’t user intuitive. It can be quite clunky, however, to get familiar with the platform you can use their trading paper account to place the first few trades.

Additionally, TDAmeritrade does not offer crypto or fractional shares.

Cons

- Platform Isn’t User Friendly

- No Cryptocurrency

- No Fractional Shares

TDAmeritrade is the most advanced of the trading platforms discussed in this article. It is great for more experienced traders who want cutting-edge tools.

Link: https://www.tdameritrade.com/

Trading Platforms Summary

There is an endless array of trading platforms, but not all of them are going to be right for you. Now that you know the differences between the trading platforms Robinhood, Webull, and TDAmeritrade, you can decide which ones check off the right boxes.

Disclosure:

I may receive affiliate compensation for some of the links included in this article at no cost to you if you decide to purchase a paid plan. This site is not intending to provide financial advice and is for entertainment only.